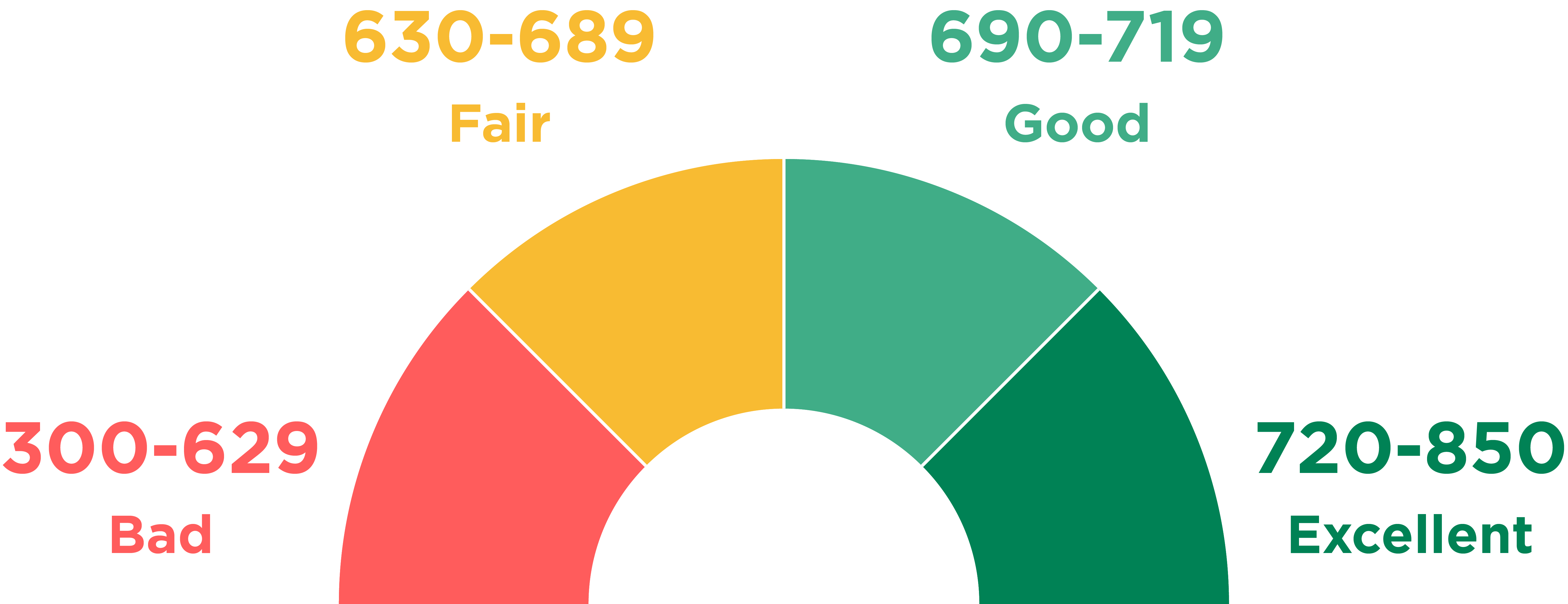

Your credit score is one of the most important numbers in your adult life. The higher your score is, the easier it can be to get a loan, a job or a place to live. Let’s take a look at how this number is calculated and how you can improve it.

Payment History Is the Largest Component of Your Score

The key to getting and retaining a good credit score is paying bills on time. Payment history makes up 35% of a credit score, which means that it is important to keep track of when bills are due. A payment is considered missed if it is 30 or more days past due. If you have missed payments on your credit report, make arrangements to get current as quickly as possible to mitigate the damage that it can cause.

How Much Do You Owe?

The amount of debt that you have makes up 30% of your credit score. Therefore, even if you have no missed payments, a high level of debt could sink your score or keep it lower than it could be. Applying for more credit or making more than the minimum payment on balances currently owed could help to reduce your credit utilization rate. It could also reduce your debt-to-income (DTI) ratio, which measures how much debt you have compared to your monthly or annual income.

Experience With Debt Can Help Your Credit Score

The longer your credit history is, the more likely it is that lenders and others will want to work with you. This is because someone who has a long track record of managing money is typically considered to be more trustworthy. The length of your credit history is determined by averaging your oldest and newest accounts together. Therefore, it may be possible to lengthen your credit history and improve your credit score by cancelling your newest accounts.

How Structured Settlements Impact Your Finances

If you receive money from a structured settlement, it may be used to qualify for a loan. Furthermore, it could be used to pay off old credit card or other types of debts accumulated before you were hurt. An attorney or financial adviser may be able to provide more details about how a settlement could impact your finances and recommend trusted structured settlement companies.

Your credit score could change anytime a credit agency receives new information from creditors or other sources. Therefore, be sure to check your credit report regularly to stay on top of what others are saying about you.